Our monthly briefing summarising key events in financial markets, from Neil Birrell, Premier Miton’s Chief Investment Officer.

For information purposes only. Any views and opinions expressed here are those of the author at the time of writing and can change; they may not represent the views of Premier Miton and should not be taken as statements of fact, nor should they be relied upon for making investment decisions.

Investing involves risk. Premier Miton is unable to provide investment, tax or financial planning advice. We recommend that you discuss any investment decisions with a financial adviser.

All good things are worth waiting for, but not all things you wait for are good

The deadline the US set for agreeing trade deals with other countries came and went with only eight being announced and even then they are still subject to details being agreed and signing. Some of these “deals” are meaningful and others went through because counterparties were in a weak position or capitulated. The deals with Japan and the UK are probably meaningful, South Korea maybe so, China is ongoing, but would fit in that bracket, whilst Vietnam, Indonesia and Philippines were in a weak position and there will be many in the EU who would argue their negotiators capitulated.

1 August has brought a deluge of tariffs being imposed by the US on countries all around the world. The headline numbers look scary in many circumstances, but as we have seen many times already, it is unlikely they will stick at these levels in most cases.

The last time US tariffs were at this level is getting on for 100 years ago, when they were raised during the protectionist period of the 1930’s, contributing to the collapse in global trade during the Great Depression. They were also high during the last Trump administration. There is no reason to think another depression is on the way, the world is a very different place now and the economy is not comparable.

However, before Trump version 2, tariffs were low, as it stands on 1 August the outcome is worse than initially anticipated, but not as bad as it could have been, which is broadly being taken as good news by financial markets. If that makes sense? However, as I have said many times; tariffs reduce economic activity and growth, create inflationary pressures, increase unemployment and reduce company profitability. None of which are good.

Meanwhile, the economic data looks ok, for now

There is a saying that economists and investors use at times; it’s a Goldilocks economy, referring to the nursery rhyme. This means it’s not too hot (i.e. a booming economy) nor too cold (i.e. recession like conditions), but just right.

On the face of it, the US economy does look to be about right for now subject to the impact of tariffs. However, depending on your starting point and which side of the argument you want to be on, you can find economic data in the US that is either comforting or really quite worrying.

There are many, many indicators to look at. The most recent economic growth figures for the second quarter of the year were encouraging, but they were flattered by a strong bounce back from a bad first quarter. Worryingly,

inflation is staying high and within that core inflation, which excludes the more volatile food and energy process, has been rising, driven by the price of goods, again, before the impact of tariffs.

A key indicator of the health of the US economy is employment. It is relatively easy to hire and fire people in the US, so jobs data moves quickly to reflect how employers are doing and how they see their future. Jobs growth has been slowing through 2025 and, excluding the COVID period, is back at levels immediately following the 2008/2009 global financial crisis. The weakening employment market was emphasised in the July data that was released on 1 August. Businesses are cautious about hiring staff with the uncertainty surrounding the outlook.

The US government has a massive problem in funding itself, which has been exacerbated by the passing of the President’s tax bill through Senate and households have a high degree of leverage into the housing and stock markets.

So, whilst there is plenty to be reassured by, there is plenty to worry about as well.

Very briefly, the same cannot be said of the UK, where economic growth is weak, inflation resilient and where households are well off but aren’t spending, presumably worried about what is to come by way of tax rises. As in the US, the UK government needs to do a huge amount to meet its spending plans. There will be many reasons to write about that in coming months.

Meanwhile in markets….

In the US, the S&P 500 Index, which is the leading indicator of the equity market, hit an all time high, as did the Topix Index in Japan. The UK market did so recently as well. Clearly those concerns I noted above, are not concerns for everyone, unless there is just too much complacency around at present, which may well be the case.

However, there are many factors that drive share prices. Recent geo-political issues have calmed down, we are also in the important period of companies reporting on their revenues and profits for the second quarter and guiding on the outlook. Overall, it has gone well, particularly in the case of the giant technology companies that are part of the boom in artificial intelligence (AI).

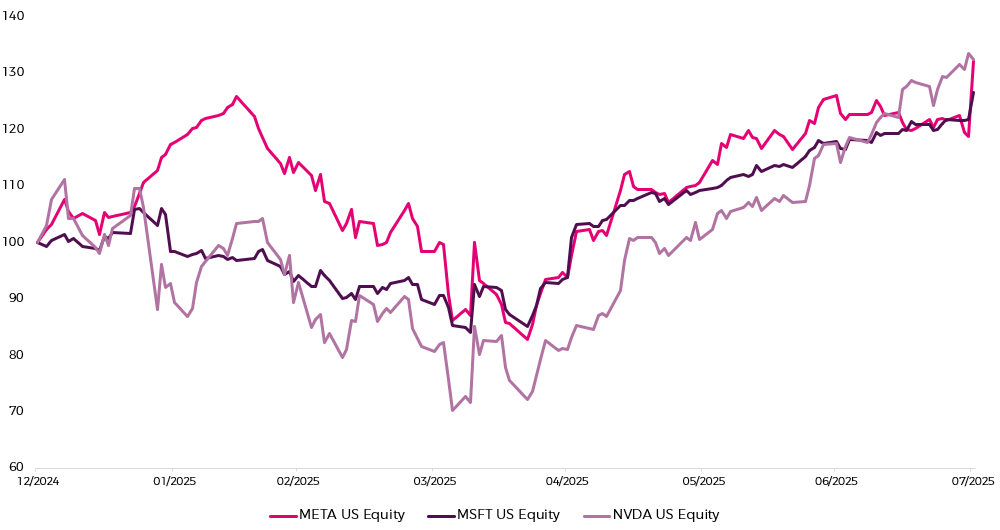

Share prices of Microsoft, Meta and Nvidia, rebased to 100. 1 January 2025 – 31 July 2025

Source: Bloomberg 01.01.2025 to 31.07.2025. The performance information presented on this page relates to the past. Past performance is not a reliable indicator of future returns.

These are enormous companies. Nvidia is the largest company in the world, with a market capitalisation of over $4 trillion, Microsoft is second at nearly $4 trillion. Meta is the sixth largest at nearly £2 trillion with only Apple, Amazon and Alphabet (Google) also above it.

These companies’ share prices have been so strong and they are of such a size they have a significant impact on the market indices that relate to the world. In fact, together, they account for just over 20% of the Bloomberg World Large and Mid Cap Index.

In their second quarter results, Microsoft and Meta displayed very strong growth, way ahead of what was expected and provided guidance of good future growth. Apple and Alphabet were also very positive, whilst Amazon was underwhelming and we wait for Nvidia in August.

I struggle to agree with those who think this is a technology or AI boom similar to the DotCom boom around 25 years ago. Of course, this doesn’t mean these companies’ share prices will keep going up; they could become expensive in valuation terms or not meet expectations or fall out of favour, they have shown significant weakness in the past when they have not met expectations, but they can’t be ignored.

There is a clear risk though, if the industry or the companies do not deliver, they are so big, that when their share prices do fall, they have an equally big downward effect on equity markets, which is likely to have a widespread effect.

But, for now, it looks like Goldilocks is right.