Our monthly briefing summarising key events in financial markets, from Neil Birrell, Premier Miton’s Chief Investment Officer.

For information purposes only. Any views and opinions expressed here are those of the author at the time of writing and can change; they may not represent the views of Premier Miton and should not be taken as statements of fact, nor should they be relied upon for making investment decisions.

Investing involves risk. Premier Miton is unable to provide investment, tax or financial planning advice. We recommend that you discuss any investment decisions with a financial adviser.

IN BRIEF

- The US trade tariffs and negotiations have totally dominated the news.

- It is very difficult to know just how big an impact they are actually having on economies.

- Financial markets were more of a big dipper than a roller coaster.

Trade chaos

It’s hard to think just how the management teams of global companies or even small companies who do business internationally are managing the on / off / pause nature of the US tariff implementation – it’s not just the if and when, it’s the how much.

It will be the same for national governments. Think back to Brexit and those complex and elongated trade agreement discussions. Very, very few meaningful agreements as complex as the ones taking place now are settled in a few weeks.

We hear and read stories of how international trade is being damaged, with container ships remaining in port, empty seats on planes going to the US and companies adjusting their spending plans and investment strategies. None of it can be surprising.

The real short term economic impact

There are many types of economic data. It has become popular to categorise them into “soft data” and “hard data”. Soft data is taken to be statistics or information such as consumer and business sentiment surveys – how those two groups are feeling about life, inflation, business conditions, their prospects and similar factors. It could also be Purchasing Managers Indices, which are surveys of those in charge of budgets and spending in businesses in different industries around the world.

Hard data is what has actually happened, for example a country’s Gross Domestic Product (GDP), which is a measure of the total value of the goods and services within an economy, or employment data. If these are rising, it shows an economy is growing and slowing if they are falling.

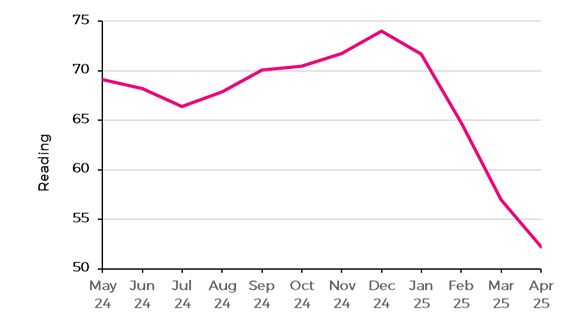

For some months now, a number of soft data indicators have been falling, leading to fears of an upcoming recession and the expectation has been that it will start to show up in the hard data. A good example is the US University of Michigan’s Consumer Sentiment Index.

University of Michigan Consumer Sentiment Index over 1 year to 30 April

Source: University of Michigan Consumer Sentiment Index; 30.04.2024 – 30.04.2025 and Bloomberg.

However, the hard data is not showing the same trends everywhere. The picture is being clouded by how businesses and consumers have been behaving in anticipation of trade tariffs. In the UK, retail sales have remained buoyant, as has inflation, in the face of uncertainty. Meanwhile in Europe the economy is has shown signs of weakness, however, inflation has remained higher than expected.

Inevitably, everyone is looking at the US, which is the key economy for global growth. For the first quarter of this year the US economy was weaker than expected, contracting mainly due to a surge in pre-tariff imports. Consumer spending was weak as well. None of that should be surprising, but it is still negative news and it’s difficult to think that the consumer is in a much better place today.

Meanwhile, the US jobs market held up well in April – much better than expected, although revised data meant February and March were weaker than thought. This is somewhat contradictory to the weakness in GDP. If an economy is slowing you would expect unemployment to rise.

It’s hard to know just how much current economic hard data reflects the true underlying strength of any economy at present. There can be little doubt that economic data is being impacted by the introduction of US tariffs as companies and consumers alike adjust spending and investment patterns through the uncertainty. It will take a while to work through to a clearer picture.

Life is a big dipper

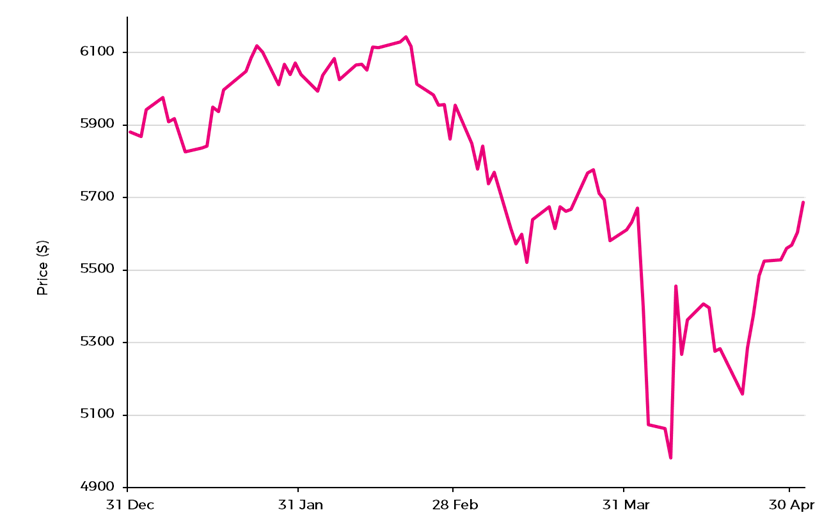

As you can see from the chart below showing the S&P 500 Index, the best indicator of the US stock market, it has been on quite a ride. It was weak as news of trade tariffs came from the White House after the President’s inauguration, then fell sharply from 2 April, before bouncing back as the 90-day delay to their imposition was announced. Since then, there have been moves up and down. However, by 2 May the index was back at where it was on 2 April, driven by hopes that the impact of tariffs won’t be as bad as previously hoped.

S&P 500 Index 01.01.2025 - 02.05.2025

Source: S&P 500 Index, Bloomberg. The performance information presented on this page relates to the past. Past performance is not a reliable indicator of future returns.

Personally, I find this quite surprising. Trade tariffs should be expected to reduce GDP growth, increase inflation and unemployment and reduce company profits. The stock market has barely taken this into account after an initial fall. Of course, they may not end up being introduced or be minimal in scale, but meanwhile, all the uncertainty will be damaging. Bond markets have been impacted as well, inevitably, although again, probably not by as much as they should have been.

I therefore think it is important for investors to proceed with caution at present.

Although, and very importantly, there are many parts of different asset classes that provide fascinating opportunities. Within equities, the UK and Europe are interesting, looking relatively good value. Companies in the healthcare sector should be relatively immune from the uncertainty, as should utility companies and others that are less impacted by economic weakness, such as those in the food industry. High quality bonds issued by companies can provide good returns and the real estate sector in Europe and the UK looks good for the long term.

In my view, it’s more about which bit of each asset class (bonds, equities, or any other) you are invested in, than the asset class itself. Even though the outlook is uncertain, there are still many opportunities for investors.