In this Q&A, Head of Investment Trusts Claire Long asks fund manager Gervais Williams to summarise the thinking behind the trust’s strategy and why diversity of income is so important.

For information purposes only. Any views and opinions expressed here are those of the author at the time of writing and can change; they may not represent the views of Premier Miton and should not be taken as statements of fact, nor should they be relied upon for making investment decisions.

Investing involves risk. The value of an investment can go down as well as up which means that you could get back less than you originally invested when you come to sell your investment. The value of your investment might not keep up with any rise in the cost of living.

Premier Miton is unable to provide investment, tax or financial planning advice. We recommend that you discuss any investment decisions with a financial adviser.

For further information on the risks of investment and glossary terms please refer to the end of the document.

An introduction to the Diverse Income Trust (“DIVI”)

Launched 14 years ago in April 2011 and managed since then by Gervais Williams together with fund manager Martin Turner, the Diverse Income Trust was set up with the twin objectives of an attractive and growing level of dividends coupled with capital growth over the long term. In this Q&A, first recorded as a video which you can watch here, Gervais talks us through the investment approach and discusses whether we are seeing the start of the long-awaited small-cap rally.

Q: Could you summarise the trust and your approach?

The nature of the trust is that it’s an income fund: it aims to generate a good income and grow over time. As the income accumulates over time we look to get an attractive return. Ultimately, if you can get an attractive level of income growth, you can enhance the growth of capital further (through reinvestment of that income), The level of income paid may fluctuate and is not guaranteed. “Capital” refers to financial assets or groups of investments.

Q: What are the benefits of your multi-cap strategy?

The nature of the trust, being a multi-cap portfolio, is that it invests in big companies as well as medium-sized and smaller ones, some of which are on the Alternative Investment Market (“AIM”, the sub-segment of the London Stock Exchange catering for smaller companies). So, the opportunity for the trust is to invest in all those stocks which are generating good and growing income. It isn’t just restricted to the largest companies – there are some younger companies, some immature companies, some AIM-listed companies – which are growing their dividends faster, so by including all the companies that are in the UK universe it means we can participate not just [by investing] in more companies but actually in more companies that are growing faster and producing better income growth as a result.

In certain market conditions, companies may reduce or even suspend paying dividends until conditions improve. This will impact the level of income distributed by the trust.

Q: The trust’s portfolio currently comprises around 100 holdings, which may seem quite a long list, but as the trust’s name suggests, this also forms a cornerstone of your investment approach, doesn’t it?

Well, it’s quite easy to buy shares in a big company, but it’s not always easy to buy shares in small companies, so while we may want to buy a small company, we can’t always buy 2-3% into a single holding, so as a result we’ll buy 1% or even 0.5%. This is not a problem; the advantage is if you back your companies and buy good companies, even small-caps (smaller companies by market capitalisation, the total value of all shares), you can put more capital to work. Most particularly, this approach makes it much easier to access the full range of companies rather than just restrict yourself to a relatively narrow band of the larger companies.

Q: Have the dividends paid by the trust grown consistently since it was launched?

Yes, and actually that’s not a trivial question. If you look at global stock markets and particularly the UK stock market, during the 2020 pandemic we saw a lot of mainstream companies cut their dividends, and indeed lots of smaller companies, too, with the result that available income fell. What’s been interesting in the UK market subsequently is that although income has recovered, it’s not recovered to where it was in 2019 but is still below that level. In fact, many of the more mainstream companies are buying back their shares, probably more than paying dividends.

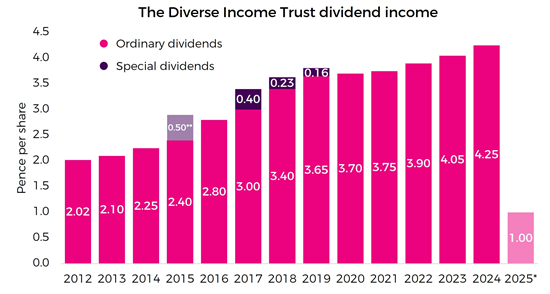

From the trust’s perspective, while its revenue per share fell in the year to May 2020, by May 2021 its income was well on its way to a return to May 2019 levels, and importantly we’ve seen it increase by each year thereafter. In other words the overall income generated by the trust – the revenue per share – has actually grown and the dividends it pays have followed that, by virtue of the fact that the income from each company in the portfolio has continued to come through and has grown steadily over time, irrespective of the fact that income from the market as a whole has not.

Source: Premier Miton. Total distributions paid for each financial year of the Trust, ending 31 May. *The income for the 2024/25 financial year represents 1 out of 4 payments. To allow shareholders to vote on the dividend, a final dividend was introduced in the year that ended 31 May 2015, resulting in five dividends for that year. Since then, the Company has paid three interim dividends and a final dividend each year. 1Source: Bloomberg, the historic yield reflects distributions declared over the past twelve months as a percentage of the trust price as at 31.03.2025. It does not include any preliminary charge, and investors may be subject to tax on their distributions. Past performance is not a reliable indicator of future returns. The level of income paid may fluctuate and is not guaranteed.

Q: How do you balance the need for income with the search for capital growth?

The important thing to say here is that the company comes first. Management teams don’t generally pay out income that they know might be unsustainable longer term. We’re looking for companies that are investing hard, generating good returns and have surplus cash. At that point they can start to pay income.

And why should they pay income? Mainly because doing so gives them “permission” to raise capital. Going forward, if we are perhaps facing more unsettled times – we saw an unsettled period during 2020, for example, and there may be other similar periods to come – and if a company is paying dividends, it should be able to continue to raise capital, even if it's relatively difficult for other companies to do so. Such companies can then take advantage of downturns to accelerate their earnings growth by buying companies from the receiver.

So, while income is second – the health of a company must come first – once we find a successful company that is in a “purple patch”, then income should come through, and as it does so it should ultimately boost the share price, contributing to the total return.

Q: Could you tell us more about why the diversity of the trust’s income is so important?

By holding the number of companies that we do, it means the trust has lots of little pockets of income coming together to form the dividends paid out by the trust, rather than relying on just a few major holdings that might do really well… or might disappoint and cut their dividends.

In other words, this approach produces a much more sustainable income, and as importantly over time, because we’ve got a number of less mature companies coming through, or companies that happen to be in the right place at the right time, this means the income has the potential to grow faster, as well as being more sustainable. It’s the combination of the two that is important.

Q: Why is meeting company management so important?

Meeting management teams is all about conviction and understanding. The very large companies may offer group meetings for investors, which don’t always offer the same opportunity for understanding, whereas as we move down the market capitalisation range, we get more opportunity for one-to-one meetings, which in turn provides scope for better understanding of the risks involved as well as the opportunities.

Importantly these are also two-way conversations: we can bring something to a meeting and suggest actions to company management that might contribute further to their success. Also important is how management talk about their companies and explain what they are achieving: as they get better at explaining their story that may be reflected in an improvement in valuation and therefore ultimately in the success of the company longer term. It’s a two-way process, and one which we believe adds a lot of value relative to many of our peers.

Q: Do you and Martin have complementary skills as co-managers of Diverse? Do you sometimes disagree on which stocks you should buy, and if so, how do you resolve this?

Yes, we are different, and we certainly don’t want to be clones of each other. Martin has a receivership background so has definitely seen the downside, whereas I’ve come from the more traditional fund management side. But we apply the same process – our traffic light approach – so it doesn’t matter who goes into a meeting because we assess companies in the same way.

Our traffic light system is all about finding good and growing income, strong balance sheets, management teams who are offering outstanding levels of service to their customers and motivating their staff. All of these features must come together, which means we are likely to emerge from a meeting with almost identical views and are unlikely to disagree.

Of course we do disagree occasionally, and if so, we won’t get involved in that particular opportunity – there’s plenty more fish in the sea!

Q: Can you explain the annual redemption?

Every year the Board offers all investors the opportunity to redeem their shares. If, say, 1-2% of shareholders opt to redeem their shares, this will likely be met by cash from the portfolio; if more like 15% want to redeem, then we are likely to put 15% into a designated ringfenced pot, which may take a few weeks or a couple of months to liquidate it, then we send cash back to the redeeming shareholders.

Why do we offer this? Primarily because while one of the great advantages of investment trusts is their potential to offer a great longer-term return, sometimes their share prices don’t keep up with their net asset values, resulting in a discount which at times can become quite significant. One of the ways to offset this is to balance buyers and sellers in the market, so that potential investors who feel they may need to sell in the medium term but want to take advantage of a near term discount, know that there will be an opportunity to redeem in the next 3-6 months. This means the trust’s share price tends to track its Net Asset Value (“NAV”) more closely than trusts without this facility.

Longer term, if this helps the trust’s share price to move to a premium, it will enable the trust to expand by issuing shares. By becoming larger, unit costs – management and other overheads – will come down, making the ongoing charge of the trust lower, in other words slightly cheaper for investors. Equally, the more shares that are traded each day, the easier it is for investors to buy and sell. So ultimately the redemption process serves to make the pricing mechanism more efficient.

Q: Are we now seeing the start of the long-awaited small-cap recovery?

Yes. Only the very early stages; it’s still very unproven. But the nature of it really is that during globalisation it’s all been about bigness, about capital appreciation, particularly in the US, where the performance of the stock market has been incredible.

We believe good and growing income is a nice way of making money – it provides a regular credit into investors’ bank accounts every quarter – but it has seemed rather boring.

Now we’re moving into a rather more unsettled period it seems; with President Trump in power, we’ve got far more open-ended risks and while we may be beginning to see the US stabilise, we are also starting to see the UK market outperform. This is what we’ve been waiting for, coming from extremely low valuations. We think investors may start to take money out of some of the capital growth strategies and reinvest into income growth strategies.

This is what we have just started to see glimpses of over the last few months: the UK has been one of the top performing markets, outperforming the US, outperforming the Magnificent Seven… We believe this is just the start, and importantly, smaller companies haven’t started moving yet, but the elastic is stretching. Valuations are already cheap because smaller companies have been out of fashion for the last few years, and we expect to see that elastic “twang” back up over the next few months. So, while we haven’t seen the small-cap market move as yet, we are much, much more confident about it doing so.