Neil Birrell, Premier Miton’s Chief Investment Officer and lead manager of the Premier Miton Diversified fund range, reflects on recent events, ponders over what might be coming next – and shares what it’s like in the office at times like this.

Marketing communication.

For information purposes only. Any views and opinions expressed here are those of the author at the time of writing and can change; they may not represent the views of Premier Miton and should not be taken as statements of fact, nor should they be relied upon for making investment decisions.

Investing involves risk. Premier Miton is unable to provide investment, tax or financial planning advice. We recommend that you discuss any investment decisions with a financial adviser.

In all the years my career spans, I have been through a very wide range of economic and financial market events that have generated extraordinary moves in the prices of bonds, equities, gold, oil and every other asset class you can think of. However, I cannot recall one that has been as fast-moving, volatile and possibly irrational as what we have been through in 2025 so far.

What just happened?

As we found out through COVID, in trying to keep investors in our funds up to date we have two ways of doing so, other than the usual periodic updates we produce. When events are moving so fast, we can do so daily or even intra-day, which is problematic, and those updates are out of date quickly as well. Alternatively, we can do so when there is a particularly significant event; we have just had one of those.

The noise around US trade tariffs in the build up to their imposition on so-called “Liberation Day” was deafening. The news flow from the White House was constant, at times confusing and even contradictory. The reaction from other nations, particularly China, has not been conciliatory; a trade war has started. The rumour mill was working overtime, driving extraordinary market reactions, only matched by the denial of the truth of the rumour.

I don’t think the reaction of financial markets was surprising. However, the scale and the speed of the fall in equity markets was quite something and bond markets moved at a rate rarely seen. There cannot be much doubt that the financial market moves forced President Trump’s hand in his decision to change his mind on the introduction of, or at least delay to, the tariffs. Let’s be clear, this was a policy change, not a negotiation ploy.

The wealth of the US population is much more effected by the stock market than most other countries. It fell sharply and the economy was (still is) under real threat as companies review their spending plans. It wasn’t just stock markets that fell, US government bonds fell sharply as well, massively increasing the cost of its debt.

I think the build up to and the execution of the tariff policy amounted to the President shooting himself in the foot. He had to undertake one of the biggest economic policy reversals in modern US history. Financial markets partied hard, with relief being the driver. However, as I sit here writing this in the aftermath of the party, the hangover and reality are to the fore.

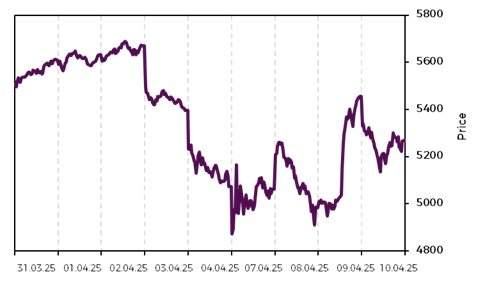

The US stock market; S&P 500 Index from 1 April to 10 April

Source: Bloomberg. Past performance is not a reliable indicator of future returns.

No one knows what will happen next, not even the US President

The pause in the introduction of tariffs, with the notable exception of China, should allow time for discussions between all parties involved. However, I don’t think we should expect there to be no tariffs come the summer. It is much more likely that they will be varied, depending on the position of strength of each side, and that tariffs will be much more specific to country and industry than broad brush.

It is also worth considering just how much trust world leaders will have in the US not to act in a volatile manner in the future. I would expect countries, where they can, to set up trade deals with each other and almost certainly to adopt the same long term approach of the US; aiming to become much more self-sufficient. That is exactly what has happened in the defence industry as a result of US policy, why not other industries? It seems the reversal of the trend in globalisation is now, in itself, irreversible.

What does this mean for the global economy?

This, I am afraid, is not predictable. Other than to say; tariffs would be expected to lead to higher inflation, lower economic activity (and therefore growth), higher unemployment and lower company profitability, amongst other things, which, in aggregate, are not positive.

The period we now sit in is destabilising and the threat of tariffs alone has already negatively impacted the economy. Put yourself in the position of a CEO of a car component company or the finance director of a clothing company that exports to the US. Would you be spending money on new equipment or hiring staff or planning strategically for the future, given the unknowns? I doubt it.

Vizion Inc, a specialist logistics company, has estimated bookings made for containers globally between 1 April and 8 April fell by half and those for US imports by nearly two-thirds, whilst bookings from China fell by over one-third.

So, it is damaging – and at a time when global growth was not very strong anyway. However, the global economy is dynamic and flexible and has proven to be resilient and self-healing. The issue is what damage might take place in the short term. That is in the hands of the policymakers. They must listen to the practitioners and what financial markets are telling them.

One positive factor, and it is a big one, is that central banks all around the world have plenty of scope to cut interest rates. Lower rates provide stimulus to the economy. The reason they haven’t been cutting them more is because inflation has remained stubbornly high. Whilst I noted above that tariffs are inflationary, lower economic activity has the opposite effect. In fact, the US inflation data just out for March showed that prices there actually fell last month, meaning the Federal Reserve Bank has more potential to take action.

What might be the impact on financial markets?

I’m not providing many certain answers in this note. One I will go for though, is that there will be ongoing volatility in asset prices. Financial markets have shown themselves to be very responsive to perceived bad news and good news alike in recent weeks. I’d expect that to continue until there is some clarity to the outcome of the tariff negotiations.

Aside from being reactive to that news, the fundamental health of the economy is going to be key. The short term doesn’t look exciting, but we all know that, and it should be reflected in prices and valuations. It’s more a case of just how tough conditions are. I really should add that there are many people who are much more upbeat on the outlook than me, and they may well be proven to be correct and, as I mentioned, interest rates could come down meaningfully. Furthermore, tariffs may not come into force as badly as threatened as of today.

I do think caution is appropriate when thinking about investments at present, but so is timescale. Volatile conditions may be more prevalent than we would like in the short term, but we should view investments in financial markets as long term.

I look at areas of the bond market today and see some fantastic returns available for very acceptable levels of risk. Whilst equity markets overall do not look cheap, our fund managers are finding some excellent companies across different regions and industries at attractive valuations which should provide rewarding share price moves over time.

Anyone who has watched their investments go up and down will know it is painful to experience these markets and to see wealth fall, but investing for the long term can provide quite the opposite.

The last word

I’m often asked what it’s like in the office when markets are flying around like they have been. The answer is that it is nothing like what you see in The Wolf of Wall Steet or The Big Short. It is relatively calm (usually!).

Our investment teams stick to their proven investment approaches and processes to look to meet the objectives of the funds they manage over the long term. They will have caution as their watchword in the short term but will be actively looking for opportunities as they arise.

Some fund managers will be much more actively trading than others. The fixed income team are very active in managing the bond funds, constantly making adjustments as interest rate expectations and market conditions change as well as buying and selling individual bonds. Some of the fund managers of equity funds across different regions hold their selected companies for the long term and will trade occasionally during market turmoil, others are much more active as prices change. Meanwhile, for multi-asset funds the fund managers will look for opportunities to switch between bonds, equities and other asset classes as big moves take place, or in individual investments within the asset classes.

Overall, the investment team mood is calm and reflective whilst sharing thoughts, but when trading opportunities present themselves, we act fast.