Neil Birrell, Premier Miton’s Chief Investment Officer and lead manager of the Premier Miton Diversified fund range, has a look at some of the current geo-political developments and their potential impact on economies and financial markets.

For information purposes only. Any views and opinions expressed here are those of the author at the time of writing and can change; they may not represent the views of Premier Miton and should not be taken as statements of fact, nor should they be relied upon for making investment decisions.

Investing involves risk. Premier Miton is unable to provide investment, tax or financial planning advice. We recommend that you discuss any investment decisions with a financial adviser.

This is how the February edition of this note started. I think it is still very apt. Given everything that is going on, the question of what’s on investors’ minds right now is a difficult one to answer succinctly. Here I will cover five key areas of importance, to my mind, anyway, as briefly as I can. Some are economic, some focused on financial markets, but they are all interrelated.

1. Extraordinary scenes

The meeting between the leaders of the US and Ukraine that was broadcast to the world was breathtaking in content and delivery. However, the outcome has been a fundamental and lasting shift in the established world order as it relates to the defence and sovereignty of nations, and it has already led to previously unthinkable changes to national fiscal policy, particularly in Germany.

It is genuinely impossible to predict what the full ramifications may be and how it might play out in time in other regions. For example, will China be emboldened to move on Taiwan? If that were to happen, it’s a whole new ball game.

Germany has been the engine of European economic growth for decades, although it has struggled since COVID. It faces some crucial issues at present as three of the pillars of its success have fallen away. It was reliant on cheap Russian oil and gas and didn’t develop a domestic energy policy, the essential Chinese end market for many of its goods has shrunk as China is much more self-sufficient, and now the ultimate defence back stop of US military power has eroded significantly. For the temporary coalition government to agree to ease constitutional government debt limits to allow spending of up 1 trillion Euros on defence and infrastructure is quite something. Of course, it has to be finalised and take place, but it is symptomatic of the rapidly changing world we are living in.

2. The big one: the US economy looks increasingly fragile

It feels like a long time ago, but you might remember home consumer and business confidence took a tumble in the UK in the lead up to the Budget at the end of October 2024. A similar thing seems to be happening in the US, but of a bigger and more fundamental scale, and it may well tip the economy into recession. In fact, some indicators suggest it already is in recession.

Consumer confidence has fallen sharply, with inflation and employment expectations being the biggest factors. Furthermore, Trumponomics does have a bit of a chaotic feel to it and the impact of trade tariffs is still to hit. Manufacturing industry has taken a knock very recently as well and business confidence has fallen, with companies anticipating job cuts. I have written about stagflation in relation to the UK recently and it now seems a possibility in the US!

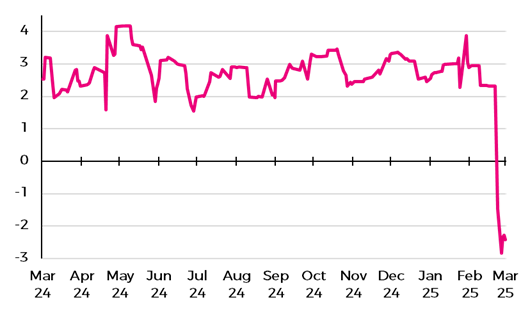

The Federal Reserve Bank of Atlanta has an economic model called GDPNow that calculates real (after inflation) economic growth by aggregating the 13 components that make up Gross Domestic Product (GDP) used by the U.S. Bureau of Economic Analysis. It provides a measure of what is happening in the US economy today. It’s not an official estimate but is seen as a guide to what is actually happening.

Federal Reserve Bank of Atlanta GDPNow

Source: Bloomberg, 06.03.2024 – 03.03.2025.

As you can see, it has shown the US economy to be growing at between 2% and 4% over the last year, until now. At the time of writing, it has collapsed to minus 2.4%. That is recession. It is such a large fall that I initially thought it must be an error. Of course, it could be very short-lived data, but it is telling.

Does it matter if the US does go into recession? Yes, it is the world’s largest economy and has trading links with everyone. This is the big one for investors at the moment.

3. Or is it? Look what’s going on in equity markets already

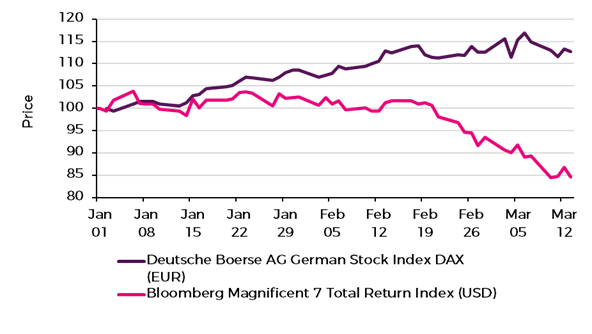

The US equity market has been the driver of the world market for some time. However, this year has seen a big reversal of that. The NASDAQ Composite Index is made up, largely, of technology companies. It has been very weak this year so far. The S&P 500 Index, which is dominated by technology and communications companies, but is a better guide to the US overall, is lower as well. The Magnificent 7 (the giant companies that have driven equity markets) are down 15% this year, whilst the German market is up 13%.

Bloomberg Magnificent 7 Index, Deutsche Bourse AG German Stock Index

Source: Bloomberg, 31.12.2024 – 13.03.2025 rebased to 100. The performance information presented on this page relates to the past. Past performance is not a reliable indicator of future returns.

This is a very significant change in leadership of world equity markets, partly driven by geo-political events and their economic ramifications (1 trillion Euros is a lot of money to pump into an economy), but also by valuations (the Magnificent 7 were expensive compared to the rest of the market and could well still be so).

Within the US there has been a big swing in popular sectors as well, which reflect the changing economic expectations. The consumer discretionary sector was doing very well. This is populated by companies that do better when economic conditions are stronger and consumers have spare cash, such as clothing retailers or home improvement stores. But this year they have gone into reverse and consumer staples companies, which sell products that are in demand in all conditions, such as food retailers and household product manufacturers, have come to the fore, as have healthcare companies. Again, a big changing of the guard.

4. Will 2 + 2 = 4?

The valuation of the US equity market has been a concern. It has been an amazing place to have invested for decades and has led the world market higher, but it has been looking expensive compared to history and the rest of the world for some time. This has been exacerbated by its increasing concentration in a small number of very large companies.

In the two sections above I’ve noted the US consumer sector is weak and the economy is showing signs of slowing, alongside that share prices are falling. This is not necessarily a significant problem but it could be a cocktail that leaves a bad taste in the mouth.

The percentage of the US household financial assets made up by equity ownership is in excess of 60% and is at a level not seen since World War II. Similarly, if you take that equity value and add the value of real estate, that comes to a percentage of household net worth higher than was seen at the time of the global financial crisis. If the US economy slows significantly, it would probably lead to higher unemployment and falling house prices. If equity prices continue to fall, particularly the very large companies that have become very popular with investors, which would not be surprising in that scenario, there could be significant move by individuals to reduce their equity exposure. A combination of selling and expensive valuations could lead to a reversal of the dominance of the global leadership of the US equity market.

There are a lot of “ifs” and “coulds” there, but it is a scenario that needs to be considered. Is US exceptionalism in an economic and stock market sense past its peak?

5. Back at home

The UK economy shrank in January. Only by 0.1%, but it shrank. It is hard to believe that it is any stronger today, given global political turmoil and trade tariff uncertainty. Businesses will be looking at their costs, including jobs, and consumers are very likely to be withholding spending as a result, just at a time when council tax bills are arriving on the door mats and water bills are rising.

The government promised growth would result from its fiscal policy, but that will take some time – many months and years – to come through. The economy has shrunk in four out of the seven months since it has been in power, and the economy in total is only 0.3% higher than it was in June. The Bank of England can provide stimulus through cutting interest rates at its March meeting, but I think that’s unlikely. They will be more concerned about inflation, but that is a bit of a tightrope to be walking.

The equity market has had a decent start to the year. Not as good as the rest of Europe, but much better than the US. The share prices of medium and small-sized companies have not kept pace with large ones, but the UK does look cheap by international comparison, and we do have a lot of very high-quality companies. In a more uncertain world, the UK does offer sanctuary.

The last word

That was all a bit gloomy, but it does feel like that. On a positive note; central banks, in particular the US Federal Reserve and the Bank of England, have plenty of scope to cut interest rates. Falling interest rates help stimulate economic growth and financial markets generally love falling interest rates.