Neil Birrell, Premier Miton’s Chief Investment Officer and lead manager of the Premier Miton Diversified fund range, looks at a current concern that is entering investors’ minds; stagflation in the UK.

For information purposes only. Any views and opinions expressed here are those of the author at the time of writing and can change; they may not represent the views of Premier Miton and should not be taken as statements of fact, nor should they be relied upon for making investment decisions.

Investing involves risk. Premier Miton is unable to provide investment, tax or financial planning advice. We recommend that you discuss any investment decisions with a financial adviser.

Please refer to the glossary at the end of the document.

A word that strikes fear

Inflation is disliked because the price of goods and services rising means that your purchasing power is reduced, unless your income is rising faster. It is also usually accompanied by stronger economic growth and higher interest rates, the latter of which should have a dampening effect on inflation. However, it is normal to have some inflation in an economy, with major central banks targeting a 2% inflation rate, as this is associated with a growing and healthy economy.

Deflation is disliked as it means prices are falling and it is associated with low economic growth or a shrinking economy. A good example is the deflation experienced by Japan for 20 or so years from 2000. This is not a good situation.

Stagflation is the worst of both worlds. It is persistent high inflation combined with stagnant or falling demand in a country's economy and often high unemployment. It is generally considered to be a bad situation, for good reason.

Does it happen often?

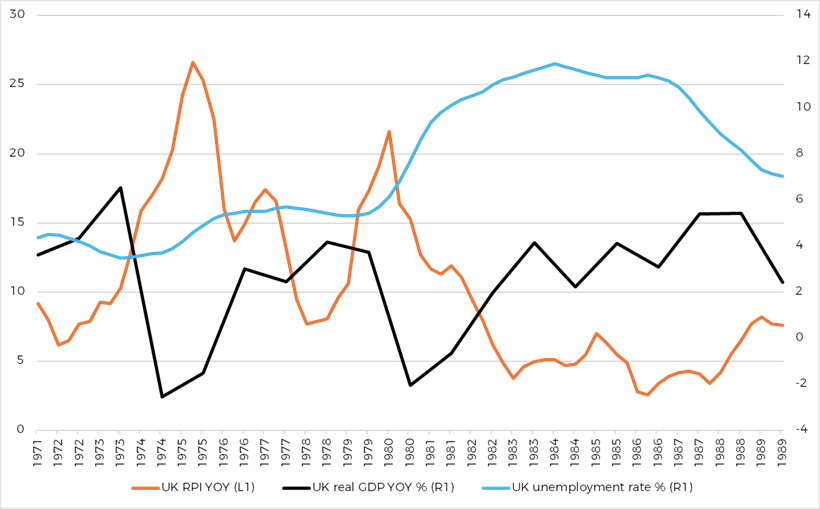

No. Whilst it might get raised as a possibility, the reality is that it is quite rare. The 1970’s is the best example of a period of stagflation and the most recent one of any scale. Indeed, it was a major problem in the US as well, partly for the same reasons that it was for the UK back then. The main problem was the 1973 oil price shock, when it quadrupled as OPEC (the Organisation of Petroleum Exporting Countries) imposed an embargo. Then, in 1979, there was an embargo on Iranian oil following the revolution there. A spike in inflation resulted, up to a peak of 26% in the UK in 1975 and economic growth collapsed, followed by a surge in unemployment, up to 12% in 1984.

The stressed economic backdrop and government policy led to industrial action by the trade unions (particularly in coal mining), power cuts and a 3 day working week was imposed by the government to conserve energy. It was a grim period for the economy.

Inflation, economic growth and unemployment in the UK 1972 - 1989

Source: Bloomberg; Year on Year UK Real Gross Domestic Product (economic) Growth, Retail Price index, Unemployment Rate.

Thankfully, it doesn’t happen very often, but you can see the damage it can cause, and it is long lasting.

Why is it being spoken about now?

When the Bank of England recently announced its interest rate cut, it also told us that it expected the UK economy to grow at 0.75% this year. That’s half of what it forecast in November, just three months ago. It expects inflation to rise to 3.7% before slowly heading back towards the 2% target rate. This outcome would probably lead to higher unemployment. Given the economy may not be growing at all at the moment, in fact it only grew at 0.1% in the last three months of 2024, the risk of stagflation is a real one.

The state of the UK economy is hardly rosy; growth is negligible, inflation is not going away and business and consumer confidence is very low. But, as you can see, the scale of the issue is nothing like the 1970’s and I can’t think of any reasons why we should get to that position. However, the economic impact of stagflation is not very appetising

So, what can be done about it?

Economies can be stimulated in many ways, but the most impactful and immediate way comes from one of two sources. Firstly, the Bank of England can cut interest rates. Whilst it may take time to feed through, it does put money in pockets quickly. The problem is that it is also likely to be inflationary. Secondly, the government can either reduce taxes or spend and invest more. Well, the government is raising taxes and its investment plans are very long term, therefore unlikely to boost growth in the short term.

Accordingly, I can see why stagflation is being discussed.

Can investment portfolios be protected from it?

Looking at history is interesting, but not always informative, as things change and situations differ. For example, telling you that the UK stock market provided an annualised return of 0.4% in the 1970’s and that it fell by 70% in 1973 / 1974 before rising by a multiple of 18 times up to the end of 1987, is interesting, but has no real relevance to today. However, it does show that stagflation can be painful for investors.

Also, in the 1970s as would also be expected with high inflation and interest rates, bonds did not provide a safe haven. In fact, the exact opposite, as we have seen in recent years.

Anyway, what can be done? Diversification is key; in equities, invest globally and across different sectors. You could focus on what are known as “defensive” sectors such as consumer staples or utility companies. In bonds, look to lower risk segments of the market. Elsewhere, perhaps look at commodities such as metals or energy. Gold is sometimes seen as a good place to have money in stressed periods. As professional investors, for a number of our funds, we will look at hedges, investments that mitigate the impact of one that is held falling and which would benefit in this environment.

There is plenty that can be done. More importantly, the risk of a period of harmful stagflation, in my view, is very low. That’s not to say we won’t experience it and some of its effects, but these should be limited, can be mitigated and don’t forget, economies and financial markets do recover. Long term investors tend to do well, over the long term!